Shift's 2023 report exposes Canadian pension funds' shortfall in aligning with Paris Agreement goals

The 2023 Canadian Pension Climate Report Card, released by Shift, provides a comprehensive analysis of the climate policies and strategies of 11 of Canada’s largest pension managers.

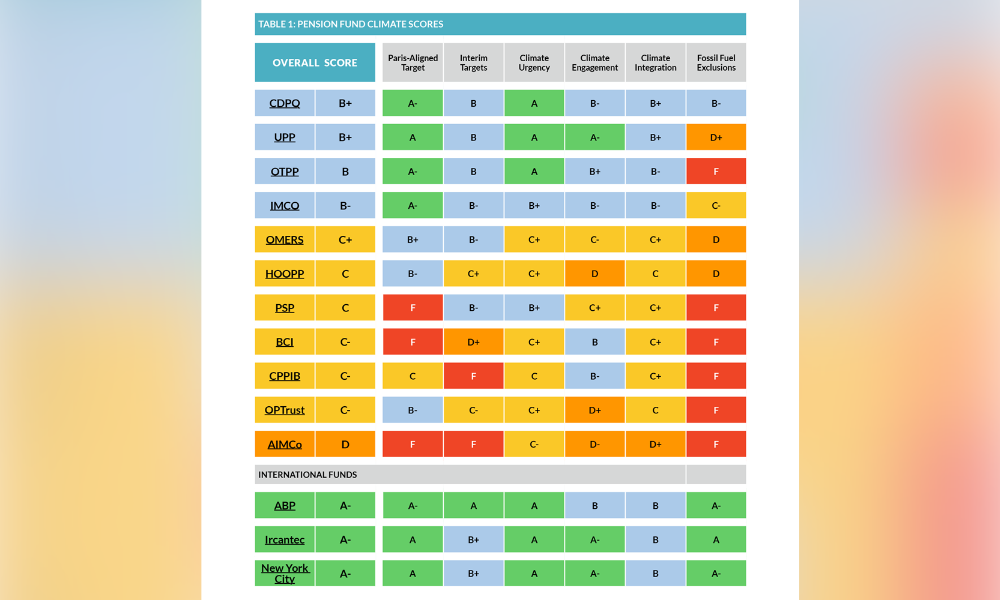

The report's findings indicate that despite some progress, Canadian pension funds still lag their international counterparts, particularly in aligning their investment strategies with the Paris Agreement's goal of limiting global heating to 1.5°C.

Laura McGrath of Shift highlighted the urgency of the situation, noting the discrepancy between the incremental pace of climate progress by Canadian pension managers and the need for more immediate action to avert irreversible climate breakdown.

The report underscores that four out of eleven Canadian pension funds lack emissions reduction targets for 2030 or 2050, emphasizing the need for credible, climate-aligned plans to mitigate the risks posed by the worsening climate crisis to both Canadian pensions and the wider financial system.

Significant progress in 2023 was observed in some funds, notably the Ontario Municipal Employees Retirement System (OMERS) and the Healthcare of Ontario Pension Plan (HOOPP), which released climate strategies.

However, the Canada Pension Plan Investment Board (CPPIB) scored lower due to problematic public statements and new fossil fuel investments.

The report also highlights a concerning trend of Canadian pension funds, including CPPIB, investing heavily in fossil fuels, despite expert advice on the necessity of phasing out such investments.

This is compounded by the fact that seven of the 11 analyzed pension managers have directors or trustees who also hold positions in fossil fuel companies.

Internationally, the report contrasts Canadian funds with leading pension funds in the US, France, and the Netherlands.

These international funds have adopted more proactive approaches, screening out new fossil fuel investments and phasing out existing holdings, thus aligning more closely with climate safety, and shifting capital into investments in climate solutions.

The report also delves into the varying quality and ambition of climate engagement strategies by Canadian pension funds. While recognizing climate engagement as a critical tool, the report suggests that few funds realistically assess its limitations.

It cites the UN Secretary-General's High-level Expert Group on Net-Zero Commitments in emphasizing that credible climate plans cannot include continued investment in new fossil fuel supply.