Q3 solvency discount rates continue to rise but will it last?

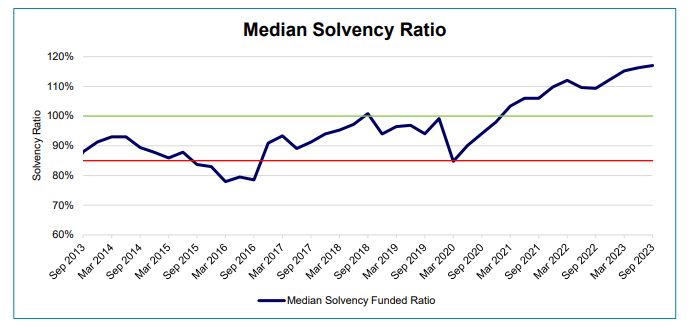

Despite a negative investment return during the third quarter of 2023, most Ontario pension plans have maintained their upward trajectory over the past year since Sept 30, 2022. This resilience has led to the median projected solvency ratio attaining a historic peak, says the Financial Services Regulatory Authority of Ontario (FSRA) in its ‘Q3 2023 Solvency Report.’

However, pension funds should take this opportunity, while funded statuses are good, to be vigilant and do what they need to do to stay funded, according to Lester Wong, FSRA’s chief actuary.

The report shows the median projected solvency ratio was 117 percent as at September 30, 2023, a one percent increase from 116 percent as at June 30, 2023. As well, the percentage of pension plans that were projected to be fully funded on a solvency basis as at September 30 was 85 percent compared to 86 percent as at June 30. The percentage of plans falling below an 85 percent solvency ratio was two percent, unchanged from last quarter. At the same time, investment returns in third quarter averaged a net return of -4.5 percent.

In addition, the report shows solvency discount rates continued to rise, leading to a decrease in plan liabilities which offset the impact of asset losses over the quarter, resulting in a small improvement in the median solvency ratio.

Global landscape remains uncertain

The prevailing high-interest rate environment has significantly bolstered the financial health of most pension plans by lowering the value of pension obligations. Furthermore, pension plans that have implemented de-risking strategies have successfully reduced volatility of the funded status of their plans. It is imperative to acknowledge that while these positive trends are indeed encouraging, the global landscape remains intricate and uncertain. Recent geopolitical events, such as the Israel-Hamas conflict, serve as a reminder of the paramount need for vigilance and agility when managing pension plans. 4

“It is vital that pension funds maintain ongoing diligence and adaptability to secure the future financial well-being of plan beneficiaries,” says Wong. “This period provides an opportunity and plans don’t want to lose it. They should take advantage of this time to make sure they stay well-funded.

“Since the lows of the pandemic, which started in March 2020, we've seen a pretty solid improvement until the most recent report for September 30, 2023. The median funded ratio changed from 85 percent to 117 percent during that time, despite the volatility and uncertainty in the past few years.

“While plans are well positioned and in good financial shape, our message is that they should be aware of the risk their plan faces. They need to anticipate all the potential scenarios, monitor them, and take a proactive approach to devise risk management strategies and ensure the right governance processes are in place.”

Wong says, through the reports, he’s noticed more interest and activity in de-risking and hedging and transferring risks from pension plans.

“This is good in the sense that it does demonstrate some proactive activity on the part of plan administrators and sponsors to properly manage their plans and this is what we advocate for.”

FSRA releases a solvency report each quarter to assess the financial health of Ontario defined benefit pension plans.