2024 private market themes – a real estate perspective

Allocations to direct real estate remain a key component of Canadian institutional portfolios, and as we begin to turn the page on 2023, many investors are focused on the evolution of the asset class going forward. Considerable changes have occurred over the past number of years, and as we emerge from a period defined by the pandemic into one with perhaps an equal amount of uncertainty, insights into growth prospects, capital flows, the cost of capital, and sector allocations will be critical in positioning a diversified portfolio of commercial real estate for the future.

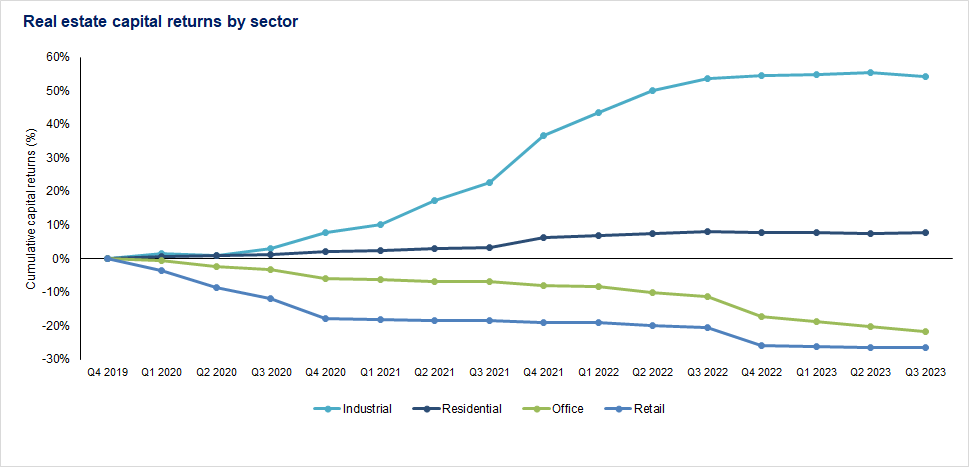

Over the past few years, the real estate market has experienced very narrow profit growth and return leadership, not dissimilar to the narrow public market leadership produced by what has been coined the “Magnificent 7” (the seven largest US publicly listed companies as of September 30, 2023 – Alphabet, Nvidia, Tesla, Microsoft, Apple, Amazon, and Meta). And just as many equity market investors have begun to question the ability of the Magnificent 7 to sustain their market-leading profit-growth levels – particularly as their performance pulled back recently and overall market breadth improved – many real estate investors have begun to ask the same questions about the industrial sector. Are past growth rates sustainable? What growth rates are sustainable? These questions are less a sign of long-term weakness than a signal of moderation and reversion to mean growth levels. Growth expectations will also have a direct impact on valuations and capital flows.

When profit growth is narrowly focused, it makes more sense to pay a premium for growth. This thesis was a key factor in the soaring valuations experienced by the industrial, residential, data center, student housing, and self-storage sectors as outsized rent increases and continued growth expectations spurred positive momentum. The low cost of capital added further fuel to the fire.

However, as the cycle turns to one in which profit growth starts to equalize across sectors at lower levels, it is prudent to seek sectors or assets with more conservative valuations. Those assets that do not demand a “premium for growth” will likely be positioned to drive better long-term returns. With regard to the real estate sector in particular, this trend could drive capital rotation back to the retail and office sectors.

Following this rotation of capital will be important moving into 2024, and investors would be wise to follow both the access trends and the pricing of capital.

Source: RBC GAM, MSCI. Represents the returns of the MSCI/REALPAC Canada Annual Property Index (Unfrozen), Standing investments

Source: RBC GAM, MSCI. Represents the returns of the MSCI/REALPAC Canada Annual Property Index (Unfrozen), Standing investments

Access to capital: follow the flows

Capital flows create a virtuous circle. Increasing access to capital increases the clarity of the underlying cost of capital; this, in turn, supports transaction activity, providing more confidence in private valuations and driving more liquidity, which, in turn, attracts more capital. If the hours 6 p.m. to 12 a.m. are a time of “increasing access to capital,” in 2023, the clock for the real estate sector was stuck at 3 p.m. In 2024, it is likely that the clock will move forward to between 4 p.m. and 5 p.m., making 2024 an important year for investors to position themselves well.

Cost of capital: unequal access to information drives valuation uncertainty

One of the key distinctions of the private market sector is its unequal access to information. The real estate sector is not a level playing field, and buyers and sellers of private assets can transact based on informational advantages, forward-looking information, and access to private due-diligence data that others may never see. It is a market of extended or accelerated timing, broad or narrow auctions, and the potential to directly add value post-transaction. Within this context, there can be a very wide range in the market’s view of the cost of capital, driving a wide range in market value opinions, and 2024 will likely be a year when beauty is once again in the eye of the beholder and there is little consensus on valuations.

Bearing all this in mind, our key takeaways for 2024 are: watch for the beginnings of a capital rotation, watch for the normalization of growth expectations across sectors, and use the year to position your portfolio for when the clock moves past 6 p.m.

Michael Kitt is head, private markets and real estate equity investments at RBC Global Asset Management Inc.